One of the most common misconceptions we see among investors is the belief that a “strong dollar” means their money is holding its value. That misunderstanding usually comes from watching the U.S. Dollar Index, commonly referred to as DXY.

At first glance, it seems logical. If the dollar index is flat—or even rising—how could the dollar be losing value? The answer lies in what DXY actually measures, and more importantly, what it does not.

What Is DXY?

Before using the acronym, it’s important to define it clearly: The U.S. Dollar Index (DXY) measures the value of the U.S. dollar relative to a basket of other foreign currencies, primarily Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.

In simple terms, DXY answers one specific question:

Is the U.S. dollar strengthening or weakening compared to other fiat currencies?

That’s it. It does not measure what the dollar buys. It does not measure inflation. It does not measure cost of living. And it does not measure purchasing power.

What DXY Is Good For

DXY is a useful tool — for currency traders and international pricing comparisons.

If you’re pricing commodities globally, hedging foreign exchange exposure, or comparing the dollar to the euro or yen, then DXY matters.

But for U.S. savers and long-term investors, DXY is largely irrelevant, because retirees don’t spend euros. They spend dollars.

The 10-Year Disconnect: A Real-World Example

Let’s look at a full decade using the same start and end dates.

Period measured: November 1, 2015 to November 1, 2025. (This represents the most recent Federal Reserve Data available.)

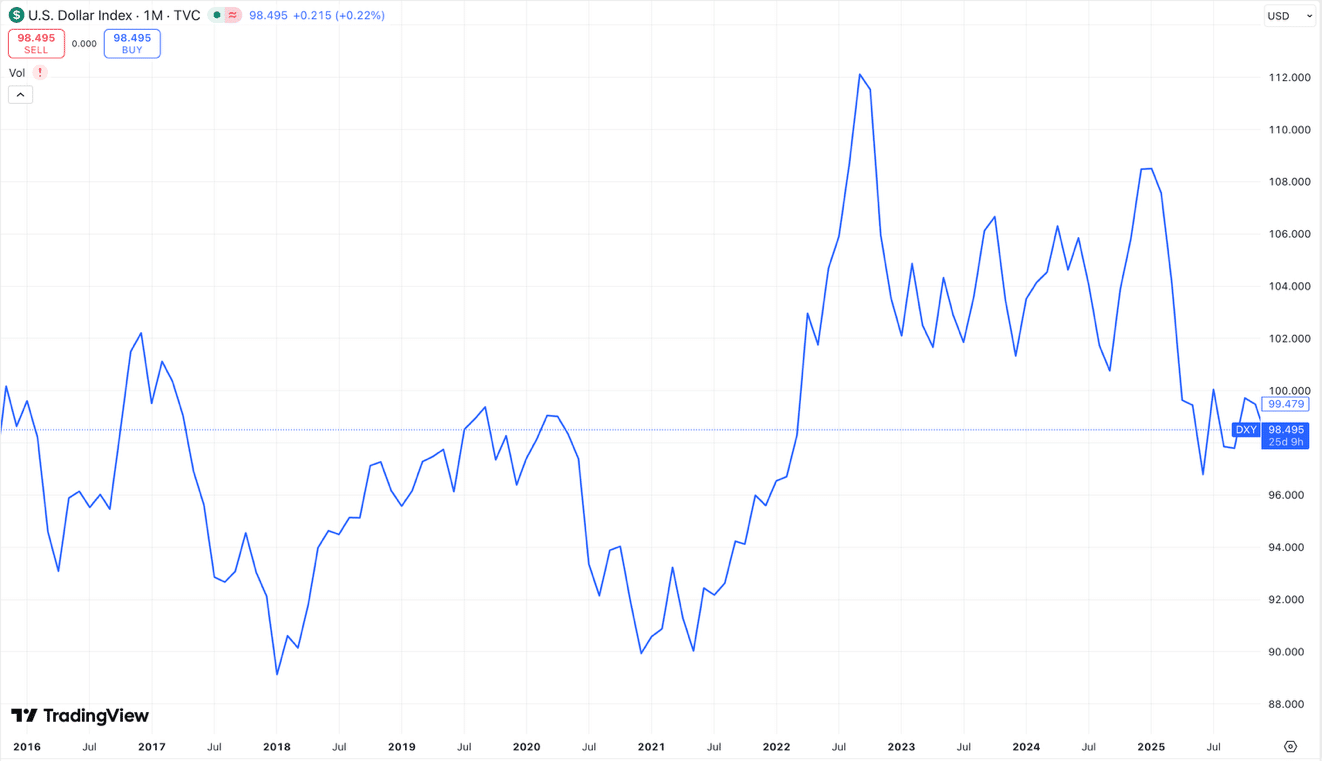

U.S. Dollar Index (DXY):

- 11/1/2015: 98.503

- 11/1/2025: 98.496

Over ten years, DXY was essentially flat, although it did trade higher and lower in different periods. If you stopped there, you might conclude the dollar held its value.

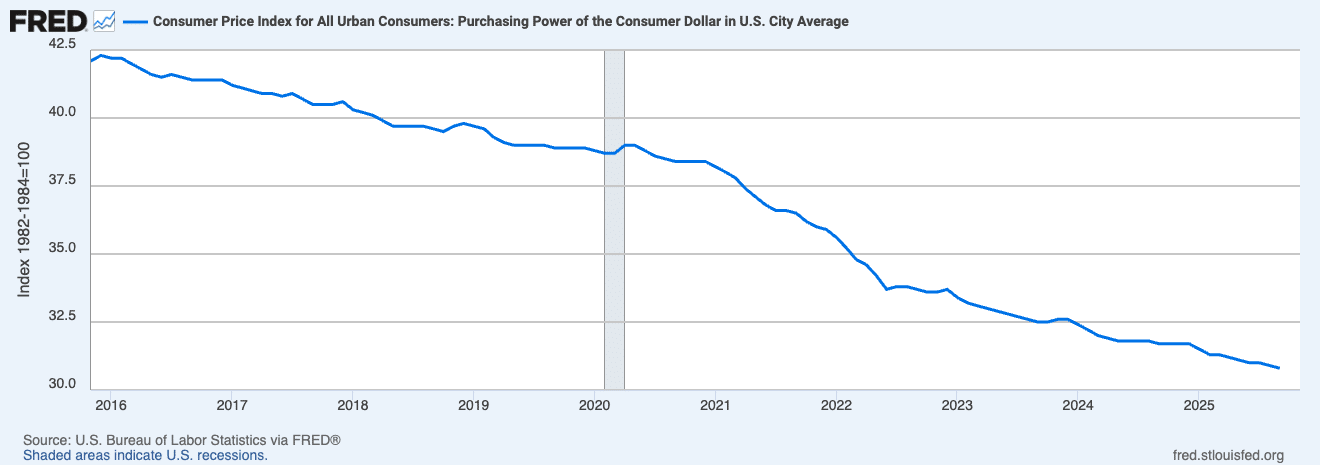

Now look at the actual purchasing power of the dollar, measured by the St. Louis Fed’s FRED index.

Dollar Purchasing Power Index:

- 11/1/2015: 42.1

- 11/1/2025: 30.9

That’s a decline of over 26% in purchasing power in just ten years. Same currency. Same decade. Completely different conclusion.

DXY compares the dollar to other fiat currencies — all of which are being debased by their own central banks.

So when every currency is weakening together, relative strength can look stable, even while absolute value collapses. This is why people feel poorer even when headlines say: “The dollar is strong.”

Strength relative to other weak currencies does not protect purchasing power.

What Savers Should Focus On Instead

If you are planning for the future — retirement, income needs, or legacy — the correct question is not: How strong is the dollar versus the euro?

The correct question is: How much will my dollars actually buy in the future?

That’s absolute purchasing power, not relative currency strength. And this is precisely why assets like gold matter. Gold doesn’t care how the dollar trades against the yen. Gold reflects how many dollars it takes to buy the same ounce over time. When purchasing power declines, gold doesn’t “go up.” The currency goes down.

Final Thoughts

DXY can stay flat for a decade. Your purchasing power cannot. For U.S. investors, especially those planning decades ahead, focusing on relative currency charts misses the real risk. The real risk is silent. It’s gradual. And it shows up every time your dollars buy less than they used to.

That’s the chart that matters.