When most people think about “wealth,” they picture a number — the balance in a savings account, the size of a portfolio, or the value of a property. But true wealth isn’t measured in digits; it’s measured in what those digits can buy. Wealth is the ability to purchase goods and services. And that ability only holds up as long as the money you’re saving retains its value.

That’s where inflation — and the policies behind it — quietly erode prosperity.

Understanding Inflation and the Loss of Purchasing Power

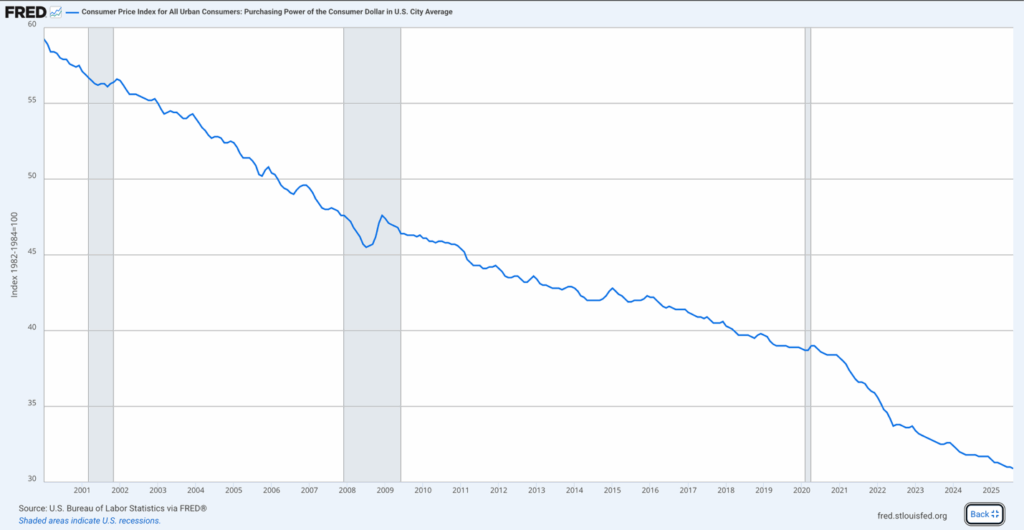

Inflation isn’t simply rising prices. It’s the loss of purchasing power caused by an expanding money supply. When more dollars chase the same amount of goods and services, each dollar buys less. The result is what economists once called the hidden tax — a slow confiscation of wealth from savers and wage earners to borrowers and the state.

You can see this clearly in the data. A dollar from the 1970s buys less than 15 cents worth of goods today. The numbers in your bank account may rise, but if prices rise faster, you’re falling behind — even while “earning” more nominal dollars. That’s why saving in a currency that’s being deliberately devalued amounts to a backdoor tax on wealth.

Policy, Not Prices, Drives Inflation

Austrian economists have long emphasized that inflation begins with policy decisions, not with supply chains or energy prices. Those are symptoms — not causes.

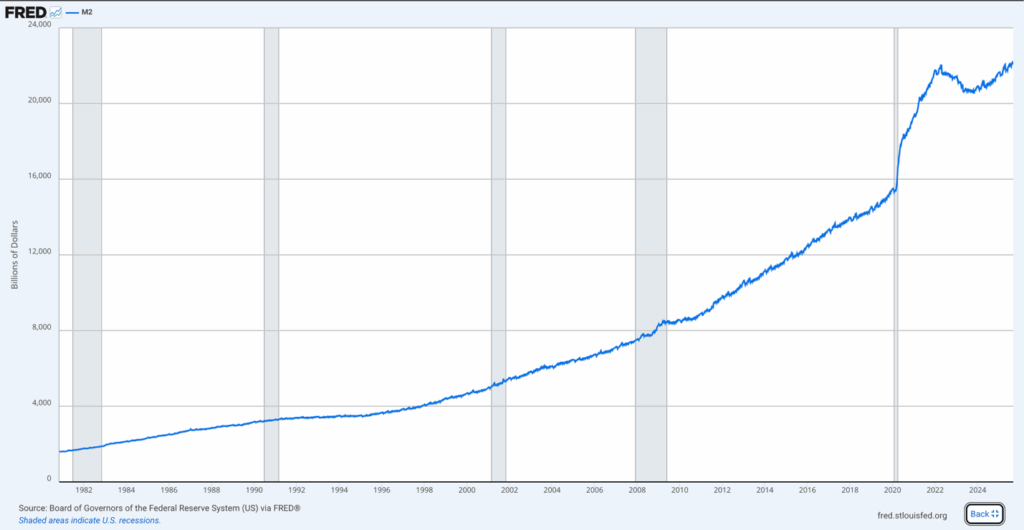

When governments spend more than they collect in taxes, they finance the gap by issuing debt. The central bank then steps in to keep borrowing costs low by creating new money to buy that debt. This is the modern form of monetary inflation: digital money creation that dilutes every existing dollar in circulation.

Whether it’s to fund wars, stimulus programs, or “temporary” bailouts, the result is the same — a growing supply of dollars and a shrinking amount of purchasing power per dollar.

Does Gold Protect Against Inflation?

Gold doesn’t create wealth, and it doesn’t generate income. What it does is preserve the value of wealth you’ve already earned.

Unlike paper assets, gold cannot be printed, defaulted on, or politically manipulated. Its value doesn’t depend on the solvency of a government or the promises of a central bank. That’s why gold has maintained purchasing power across centuries and currencies.

To put that into perspective:

- In the early 1970s, when the U.S. left the gold standard, an ounce of gold was $35 — enough to buy a tailored men’s suit.

- Today, that same ounce costs around $3,900 — and still buys a quality tailored suit.

The dollar has lost over 98% of its purchasing power in that period, while gold has held steady in real terms. That’s what wealth preservation looks like.

How Gold Preserves Purchasing Power

Gold’s strength against inflation isn’t mystical; it’s mathematical. Because gold is finite, it can’t be diluted by policy. When governments expand the money supply, the ratio of dollars to gold shifts — not because gold changes, but because the measuring stick (the dollar) does.

That’s why gold prices tend to move inversely with confidence in paper money. When people realize that “policy solutions” almost always involve more debt and more money creation, they turn to assets that exist outside the system — gold, silver, and other tangible stores of value.

Wealth That Endures

You are only as wealthy as the purchasing power of what you save.

If you save in dollars, and those dollars are being devalued by design, then your savings are silently taxed. That’s why gold and other precious metals have always served as monetary insurance — not speculation, but protection.

Bad policy chips away at wealth over time. Gold preserves it.

Solution: Gold as a Long-Term Hedge Against Inflation

Inflation doesn’t just raise prices — it reduces what your money can buy. Precious metals defend against that erosion by standing outside the system that creates it. In a world where policymakers can manufacture dollars at will, owning gold isn’t about chasing returns; it’s about keeping what’s already yours.