A Correction to the Most Misunderstood Asset in America.

James Carville famously pointed out during the 1992 presidential campaign, “It’s the economy, stupid.” It wasn’t meant to insult anyone. It was meant to refocus the conversation. To remind people that while everyone was arguing about a thousand different issues, the real driver was right in front of them.

The same thing needs to be said about gold.

For decades, gold has been marketed with noise—war headlines, fear of crashes, political panic, global uncertainty. But none of that explains why gold has continued to rise long after those events passed. None of it explains gold’s relentless, generational trend.

So let’s say it plainly and put it on the record:

It’s not the war. It’s not the crisis. It’s not the fear.

It’s the Dollar, Stupid.

I. The Flawed Narrative: Gold as a Panic Button

You’ve heard the clichés:

- “Buy gold in case of war.”

- “Buy gold if you fear a stock market crash.”

- “Buy gold to protect against geopolitical uncertainty.”

This is the shallow way gold has generally been explained to the public, and it has damaged the integrity of the message. If your argument for gold is tied to fear of a headline, what happens when that headline goes away?

- Iraq War ended. Gold didn’t fall.

- 2008 crisis ended. Gold didn’t fall.

- COVID passed. Gold didn’t fall.

Why? Because those headlines were never the real cause. They were surface-level commentary pasted over a deeper force. Events create emotional spikes—but events do not create long-term trends.

II. The Reality: Gold Isn’t Moving — The Dollar Is

Gold is not a speculative asset chasing the drama of news cycles. Gold is a measuring stick. It measures what the dollar can still buy.

The truth is: It’s the policy response to events that drives gold (not the event itself).

War doesn’t move gold. Pandemics don’t move gold. Financial crises don’t move gold.

What moves gold is what policymakers do afterward:

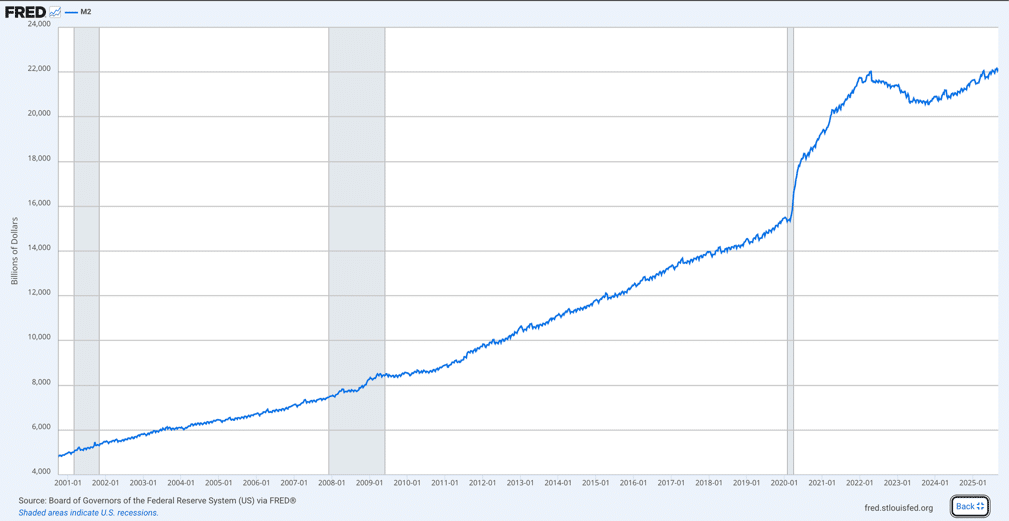

- The Federal Reserve flooding the system with “liquidity”

- Congress passing trillion-dollar rescue packages

- Deficits exploding to “stimulate” the economy

- Debt being issued, then monetized

When the United States responds to every emergency with more borrowing and more printing of dollars, and we expand the money supply…

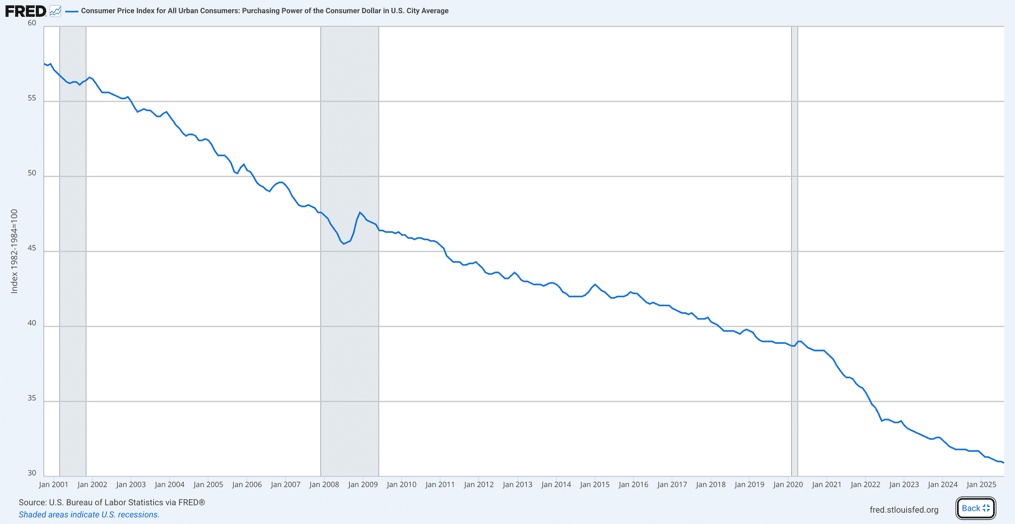

…the result is a dollar that becomes less valuable and buys less over time.

As the dollar falls, it naturally requires more dollars to buy the same ounce of gold.

This is precisely why gold never “comes back down” when the crisis itself is over—the policy damage remains. The war ends, the virus fades, the panic subsides—but the debt, the money supply, and the new baseline of spending never return to where they were.

In the end, it isn’t the gold that is moving higher. It is the dollar that is moving lower.

III. The Eagle and the 285 Dollars — A Visual Truth

Picture this:

In the year 2000—the last time the U.S. had a balanced budget—you could take a 1 oz Gold American Eagle in one hand and 285 U.S. dollars in the other, and that was considered a fair trade.

Today, in October 2025, that same Eagle requires over 4,200 U.S. dollars to be considered a fair trade.

What changed?

Not the gold.

The value of the dollar changed.

Price is simply the point at which two sides agree value is fair. If dollars lose purchasing power, you need more of them to buy the same ounce.

That isn’t fear or speculation. That is arithmetic.

IV. Gold vs. Stocks — Parallel Tracks, Not Opposites

One of the most persistent myths is that gold and the stock market are inversely related.

They are not. That idea is lazy and wrong.

Over the last year:

- Dow Jones: +8.44%

- Gold: +55.09%

They both went up — just for different reasons.

And since the last balanced budget in 2000:

- Dow: +307.40%

- Gold: +1373.11%

Here’s what this proves: owning gold does not mean you “miss out” on gains. That’s Wall Street mythology.

Most investors aren’t beating the market anyway. According to Standard & Poor’s, fewer than 1 in 8 professional active managers outperform their benchmark over 15 years. So if you’re simply “riding the index,” gold hasn’t been a drag—it has been running laps around it.

- Stocks rise on earnings and optimism.

- Gold rises on debt and dilution.

They are not enemies. They are denominated in two different realities. One chases growth. The other measures decay.

V. The Real Case for Physical Gold

Physical gold is not about short-term emotion. It’s about long-term discipline in the face of a system that will not reform itself.

- We do not balance budgets.

- We monetize debt.

- We expand the money supply.

- We erode purchasing power.

Owning physical gold is not pessimism. It is clarity. It is the recognition that you cannot print discipline. You cannot legislate restraint. You cannot campaign on austerity.

Gold is how individuals protect themselves in a system where governments refuse to protect the currency.

VI. The Mature Gold Conversation

It’s time to grow up the gold narrative.

No more blaming wars. No more chasing headlines. No more fear hooks.

Gold doesn’t respond to panic.

Gold responds to policy.

And these policies—not panic—are America’s largest unresolved issue.

So yes, let’s borrow Carville’s line, modernized:

It’s not the fear, it’s not the crisis, it’s not the headline…