In the final weeks of 2025, many investors are asking the same question: Are we finally past the inflation scare?

After all, the CPI headline number has cooled, the Federal Reserve has paused its rate-cut cycle, and markets are trying to convince themselves that the worst is behind us.

But if you look beneath the surface — not at short-term price indexes, but at the foundation of the financial system itself — the answer becomes clear:

We have very little evidence that the U.S. money supply will shrink meaningfully in 2026. And if the money supply doesn’t shrink, the purchasing power of the U.S. dollar won’t recover. It continues to erode.

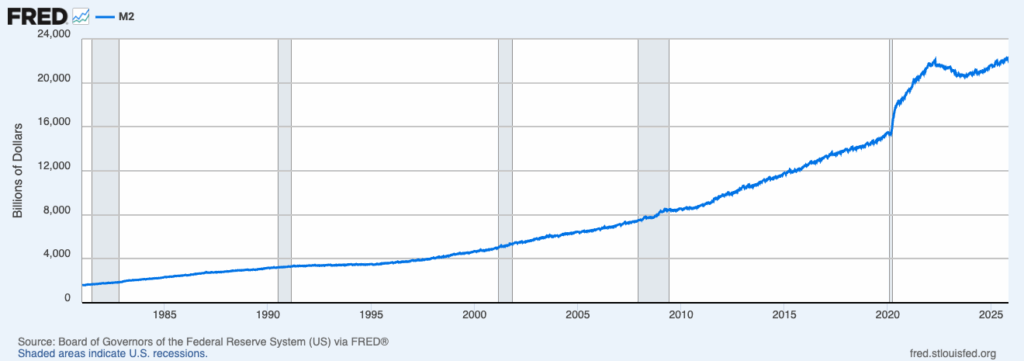

The chart below tells the real story.

The Chart That Defines the Era — M2, 1980–2025

M2 — the broad money supply — grew steadily for decades. Even during the financial crisis, the increase was manageable.

Then came 2020.

The money supply didn’t rise — it went vertical.

From roughly $15 trillion to over $21 trillion in less than a year. A historic expansion unlike anything in modern economic history. And today, even after “quantitative tightening,” M2 still sits near record highs and has resumed climbing into 2024–2025.

This is the part the public misses: QT didn’t undo the spike. QT barely dented it.

And that matters, because you cannot erase the dilution of purchasing power that comes from a sudden, massive expansion of the money supply. You can slow it, but you can’t reverse it without shrinking the base — something no policymaker has shown the political will to do.

2025: Another Year of Fiscal Reality

As FY 2025 closed, the numbers told a blunt story:

- Revenue: ~$5.2 trillion

- Spending: ~$7.0 trillion

- Deficit: ~$1.8 trillion

A deficit must be financed. Financing requires debt. And debt issuance requires someone to buy it.

Here’s where the math forces the conclusion:

There is no credible path to shrinking the money supply while running trillion-plus deficits. Not mathematically. Not politically.

Foreign buyers aren’t stepping up. Domestic buyers have limits.

And every auction that softens pushes the system closer toward the same solution it has used for 15 years:

The Federal Reserve becomes the buyer of last resort. And when the Fed buys debt, new base money enters the system.

That’s why money supply isn’t shrinking. It can’t shrink — not with current fiscal policy.

Purchasing Power Is the Real Inflation Gauge

The CPI tells you what prices did. Gold tells you what the dollar did.

Gold is not “getting more valuable” — it’s revealing the dollar’s loss of value. At $4,200 per ounce in 2025:

- it is not gold that has changed

- it is the currency used to measure it

When M2 expands dramatically and never returns to baseline, purchasing power does not recover. It ratchets down. Slowly, persistently, and permanently.

The public sees this in:

- higher home prices

- higher medical bills

- higher education costs

- higher asset prices generally

But gold measures it most cleanly because it has no earnings, no management, no innovation cycle, and no leverage. It simply reflects what a dollar can buy.

And in 2025, the dollar bought less. In 2026, that trend is likely to continue.

Looking Ahead to 2026: Why We Expect Further Dollar Weakness

Here’s what we do not have in the United States today:

- No plan to reduce deficits

- No plan to reduce spending

- No growing foreign appetite for U.S. debt

- No structurally higher national savings rate

- No political coalition willing to tighten fiscal policy

- No mechanism to retire or shrink existing money supply

Here’s what we do have:

- Rising interest expenses

- Record Treasury rollover volumes

- Persistent structural deficits

- An aging population requiring higher entitlement outlays

- A Federal Reserve that has already shown its threshold for “stability intervention”

Add those together, and the conclusion is unavoidable:

We see no evidence that the U.S. money supply will shrink in 2026.

And therefore we expect the dollar’s purchasing power to continue eroding.

Gold is not a reaction to inflation — it is a reaction to monetary reality.

As long as the money supply continues expanding, gold will continue repricing the dollar.

In Conclusion

The story of 2025 was not CPI, not rate cuts, and not market volatility. It was the continued inability — or unwillingness — to shrink the money supply.

And because purchasing power erosion is a monetary phenomenon, not a temporary price cycle:

We believe gold remains one of the clearest and most reliable ways to protect long-term purchasing power going into 2026.